CoinW KYC verification is essential in trading on its platform. In this article, we’re going to learn how to do a KYC verification on CoinW.

CoinW is an online platform for trading cryptocurrency. Users can perform trading transactions and cryptocurrency exchanges from one individual to another. Traders can also deposit and withdraw crypto assets with ease on the platform.

As is the current practice with cryptocurrency and other online platforms, it has become necessary for users to verify their identity to protect their interests and also investments.

Verifying your identity assures the platform and other users that you are who you say you are and protects you from identity fraud and thieves who wish to gain unauthorized access to your account. This protects your wallet with better and higher security.

In recent times, verification of Identity has proven to be the only way to stop illegal practices and transactions. Users who do not verify their identity are usually restricted from performing most transactions- in some cases, all transactions.

This post will help you understand everything about CoinW’s KYC verification and why it is essential, as well as see step-by-step procedures on how to perform the complete verification.

What is KYC?

Know Your Customer (KYC) or Know Your Client (KYC) are rules and protocols designed or structured to protect apps, software, individuals, companies, and financial institutions from fraud, corruption, or money laundering.

KYC has become essential in recent years due to the increasing vulnerabilities of financial institutions to illegal and criminal activities.

To perform a KYC, users must provide valid proof of Identification. In most cases, these proofs are valid means of Identification like; international passports, utility bills, or Government Identity cards. Details of the individual, like name, date of birth, and address, are the most required for verification.

The FINRA Rule

Two rules govern the KYC verification; one is the Financial Industry Regulatory Authority (FINRA) Rule 2090 (Know Your Customer) and FINRA Rule 2111 (Suitability).

The FINRA Rule 2090 states that every broker-dealer uses reasonable effort when opening and maintaining client accounts and are required to know and keep records on the profile of each customer, as well as identify each person who has authority to act on the customer’s behalf.

While; FINRA Rule 2111 states that a broker-dealer must have a conclusive belief that a recommendation is suitable for a customer based on the client’s financial situation and needs.

It is assumed that the broker has reviewed the relationship between the broker and dealer and has checked facts and customer profiles.

The broker should have checked details like the customer’s other securities before making any financial transactions on behalf of the customers.

Cryptocurrency platforms like CoinW require users to verify their identity because the decentralization of payment methods using cryptocurrency has created a loophole for criminals to explore, using it as an opportunity to launder money.

The governments of many countries have now imposed the KYC on cryptocurrency markets to align with financial institutions that require customers to verify their identity.

In 2021, FinCEN proposed that cryptocurrency and digital assets market participants should submit, maintain and verify their customers’ identities.

This proposal classifies specific cryptocurrencies as monetary instruments and subjects them to KYC requirements.

KYC is a set of requirements that financial services companies, investments, and financial institutions use to verify their customers’ identities. It provides customers with a form of protection and financial institutions with information on their customers’ identities.

Importance of CoinW KYC verification.

The importance of identity verification in the KYC cannot be overemphasized as;

Individuals and users of the platform, both buyers and sellers of cryptocurrency, are protected from the illegal activities of criminals by verifying their identities before carrying out any monetary transaction.

Unverified accounts’ activities are restricted to performing everyday activities that do not pose a threat to other users.

CoinW’s KYC verification ensures that crypto traders are who they say they are. It provides the platform with information to assess risks related to the individual and have knowledge that can be used when conducting a check or review.

In addition, the verification process ensures that users on the platform do not falsify their identities and carry out activities that might be detrimental to others.

Reasons why you need CoinW KYC verification

The complex nature of identity verification results from the demand for users from all over the world who might not be able to meet physical verification methods.

Time and geographical factors have restricted individuals from being able to meet up with physical verification demands, hence the need for alternative verification methods that overcome these limitations.

The personal identities of users are stored on a decentralized blockchain (Blockchain) and secured from other external entities.

Users’ identities are kept safe from unauthorized or illegal access by others. With your information protected, no one can access it unless you permit them to do so.

CoinW’s KYC verification helps improve its users’ experience as they get to perform all transactions without any frictions and threats. Crypto users on the CoinW platform can perform all transactions seamlessly without experiencing the restrictions that come with non-verified users.

On CoinW’s platform, users with the highest type of identity verification have access to the best available resources to carry out all crypto trading activities.

If you want to experience the best trading services on CoinW, take some time to verify your identity!

CoinW KYC verification: How to start

Let’s quickly explain how to verify your identity on CoinW.

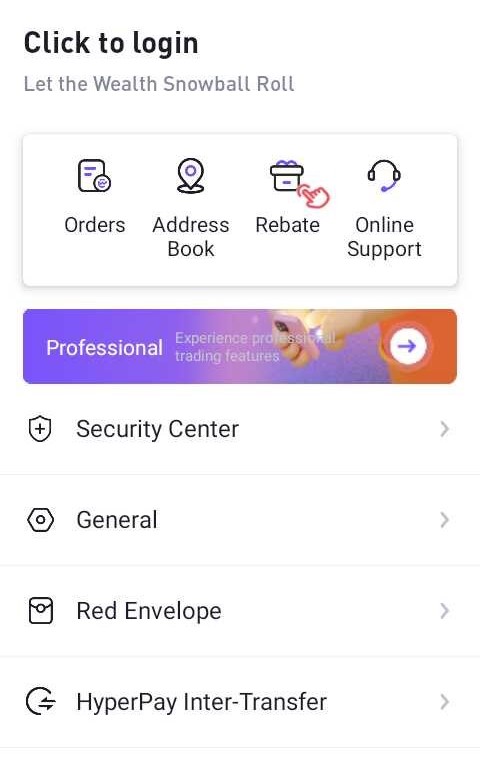

· Download the CoinW mobile app

To begin the verification process, install the CoinW mobile app from the Google Play Store. The verification process can only be completed if the mobile app is installed. If you do not have an account, you can create an account or signup using the mobile app.

Login to your account.

If you do not have an account, you can register instead.

You will receive a verification code to link up with your email address after successfully verifying your account with the verification code.

· Primary Identification

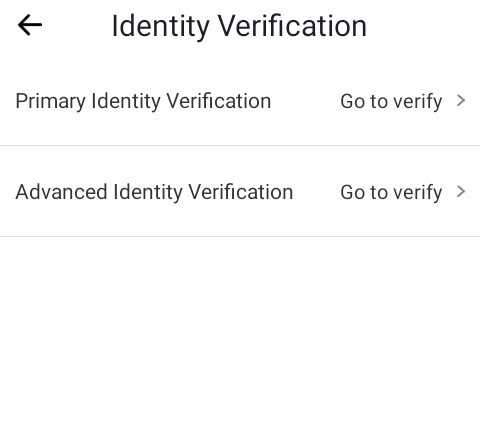

After successfully registering your account, you can verify your identity using primary verification. The primary verification is the first verification new users must perform before proceeding with the second verification method.

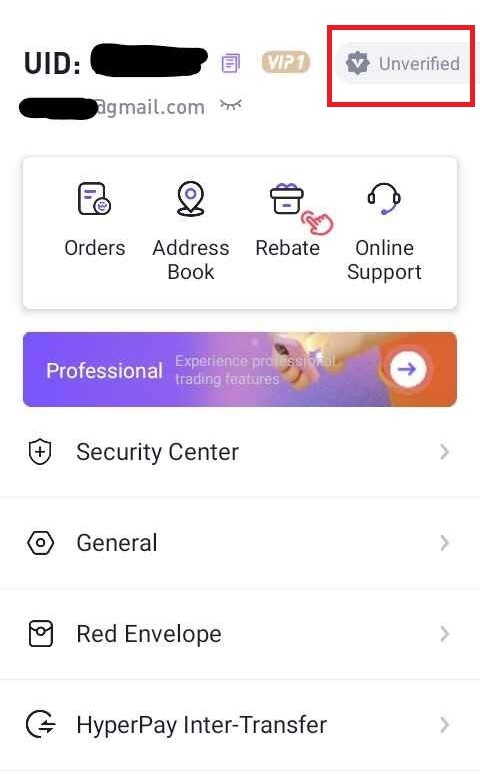

To get to primary and advanced verification, click the profile icon on the mobile app; on the right-hand side, click “unverified.”

This takes you to the Identity Verification page, as seen in the screenshots below.

Choose the primary Identity verification.

Complete all its requirements and fill in the required details.

Users who complete the Primary Identity Verification can deposit and withdraw their funds as opposed to users whose identity has not been verified.

Primary Identity Verification has enormous benefits for CoinW’s users, like the ability to withdraw and trade fiats like the USD and trade at higher rates and amounts.

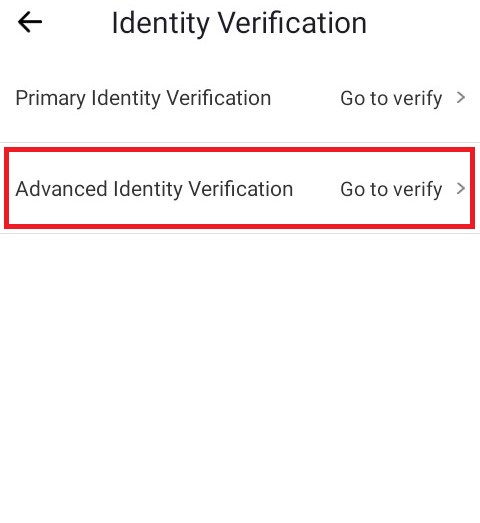

· Advanced Identity Verification

The Advanced Identity Verification can only be completed by users who have successfully passed the Primary Identity verification. This method usually requires creating a video that meets specific requirements, though the method might differ according to location.

CoinW KYC verification rejected: Top reasons.

Occasionally, users might experience the unpleasantness of having their identity verification rejected. There are specific reasons why this happened. Below are the top reasons and steps to remedy the situation.

1. Wrong ID information

Providing the wrong information or ID type can lead to your KYC verification being rejected. Your verification might have been unsuccessful because you did not use the required documents. To prevent this, you are advised to use the correct information and, more importantly, the right ID type and documents.

2. Photo information is inconsistent with ID information

Your verification might have been unsuccessful because your photo information is inconsistent or does not appear to be the same person on the ID.

This might be a result of the difference in your appearance. To solve this, provide another photo of yours with your facial features well- highlighted.

3. Photo information is not clear

When your photo information is unclear or not visible, your KYC verification might be rejected. To ensure your verification is approved, take a clear photo with the information on it. Try switching cameras and checking the lighting to ensure it does not affect the visibility of your photo information.

Whatever the reason for your KYC verification being rejected, be sure that you will receive an email highlighting the reason(s) and steps you should take to remedy it.

Conclusion

Wrapping up, CoinW’s KYC verification process is an easy process for you. To ensure the success of your verification, you are advised to follow the steps listed above, use the correct document to complete the process, and enjoy its vast benefits.

Verifying your identity also makes it easier to make money via CoinW without trading, while making it extremely possible to transact with other crypto exchange platforms like Binance and KuCoin.

If you want to experience the best trading services on CoinW, verify your identity today!

Frequently Asked Questions

Submitting the required documents for verification would typically take at least one business day. Under different circumstances, such as an increase in the number of new users, It may take longer for the verification to be complete.

Do I need to complete the identity verification before trading?

No, you need not complete the identity verification before trading on CoinW. Still, if you want to trade in the OTC market, identity verification is a requirement you must meet.

However, if your account triggers risk control, CoinW reserves the right to request identity verification from you at any time.

Can I perform the verification using my expired document?

No, you cannot use expired documents to verify your identity. Instead, use an unexpired proof of identity.

No, you cannot. It is advised that you use documents that have a validity period of not less than three months.

If you have a document that will expire in less than three months, you are advised to apply for a new one to meet the verification requirements. This would prevent your verification from being rejected.