In this article, I will show you how to trade futures on CoinW and all there’s to know about trading futures on CoinW.

CoinW futures trading is one of the most straightforward and beginner-friendly user interfaces in the trading industry today.

Its futures trading interface is like spot trading, which has helped CoinW establish itself as one of the best in the trading market.

This is an excellent advantage to the platform because if you must be successful with trading, the platform you use dramatically matters.

You might have known this, which is why you are here to learn about CoinW futures trading.

Either you are here to learn about the simplicity, get an overview of what it looks like, or just want to see the user interface.

You are still at the right place. If you haven’t downloaded the CoinW mobile app, simply download it on Google Play Store or App Store. The mobile app provides a user-friendly interface that makes futures trading easy and enjoyable. You can also register an account on the platform’s website here.

With that being said, let’s get to work.

What is futures trading?

Futures trading are financial derivative contracts that mandate two parties to buy or sell assets at a future date and time at a predictable price.

Before futures trading, the buyer or seller must sell or buy the asset at a predictable price regardless of the current market situation.

Let me take it in a more simple form.

When you are involved in futures trading, you purchase an asset at $10, and you predict that the asset will be $20 on that date.

If the price of that asset at that date comes down to $2, the trading platform will automatically sell off the asset.

On the other hand, if the price goes to $20, the platform will automatically sell it off without your consent.

Note: Once you buy or sell in futures, you don’t have control over your money again.

You can only access underlying assets, including physical commodities and financial instruments.

Futures can also be used for hedging or trade speculation.

The buyer must purchase, or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date.

Difference Between Futures and Spot Trading

So, here, we will be looking at the difference between futures and spot trading.

This will help you to widen your knowledge as you begin your journey in the trading industry.

Let’s start!

Spot Trading:

If you are in the spot market, you buy and sell cryptocurrency instantly.

This means you get whatsoever crypto you are trying to buy or exchange for instantly once the order is filled.

Futures Trading:

In the futures market, you need to open a position representing the value of a specific asset.

Once it has been opened, you no longer own the asset, but the contract you have agreed to buy or sell within a specific period will only have access to it back at the end of the stipulated date or time that you agreed to buy or sell.

If you buy ETH with USDT in the spot market, you will receive the ETH instantly in your crypto portfolio.

This means you already own ETH, and you do not longer have access to the USDT. If you must get USDT back, you must sell ETH to USDT back.

However, in the futures or contract market, you need to open a long-term position of ETH with USDT.

The ETH you buy will not be available for usage or instantly found in your futures account.

You need to wait for the stipulated date to either make your profit or make a loss. One would happen at the end.

I believe you get it now. Sure you do!

CoinW Futures Trading: What to consider before Starting

So, they’re things you need to consider before you begin your futures trading journey.

There are:

1. Leverage Assessment

Leverage assessment refers to the ability to control considerable money in the financial market.

It is usually calculated at a ratio ranging from 1:10 to 1:100.

However, the best leverage for beginners is 1:10, with a USD balance of $10,000.

Note: CoinW also offers leverage to its users.

2. Liquidity

In simple terms, market liquidity refers to how fast stock and be bought or sold at the best possible prices.

You can also see it as a market, such as a country’s stock, physical market, or real estate city, allowed to be bought and sold in an open market.

Note: Asset bought and sold with liquidity tends to be stable and transparent.

3. Expiration Date

The expiration date refers to the life span and time of when derivatives will be expired regardless of any obligations or rights.

This means that whether you like the current situation of the market or not, the trade will automatically be terminated when due.

Note: You have no power to change the date or time when your futures contract is supposed to end.

CoinW Futures Trading: How to Get Started

The primary reason you are here would probably be to learn how to start with CoinW futures trading.

And we will cover that in-depth in this section; we will show you how to get started on the official website and mobile app.

As you might have known, the first thing is to create an account on CoinW. That would always be the first step in anything trading online.

If you already have an account with them, you can continue reading, but if you haven’t created an account on CoinW, quickly follow this link to create your account and get it verified if you are a beginner that needs a step-by-step tutorial.

Then learn how to open a CoinW account here and verify a CoinW account here.

Both contents are in-depts and contain screenshots of every step.

With that being said, let’s continue.

1. Open a Futures Account

Let’s quickly run through how to open a futures account on CoinW. We will go through it for the web and mobile app.

You must download the mobile app from Google Play Store or App Store if you use your smartphone.

Even though you want to use your laptop, you can’t be going around with a laptop every time. So, download the mobile app here now.

Before opening a futures account, you must sign up with CoinW on the official website or mobile app.

The sign-up process is simple; it’s like signing up for a social media account or our day-to-day activities app.

With that being said, let’s begin our future account creation.

Website

So, what you need to do now is to log in to your CoinW account.

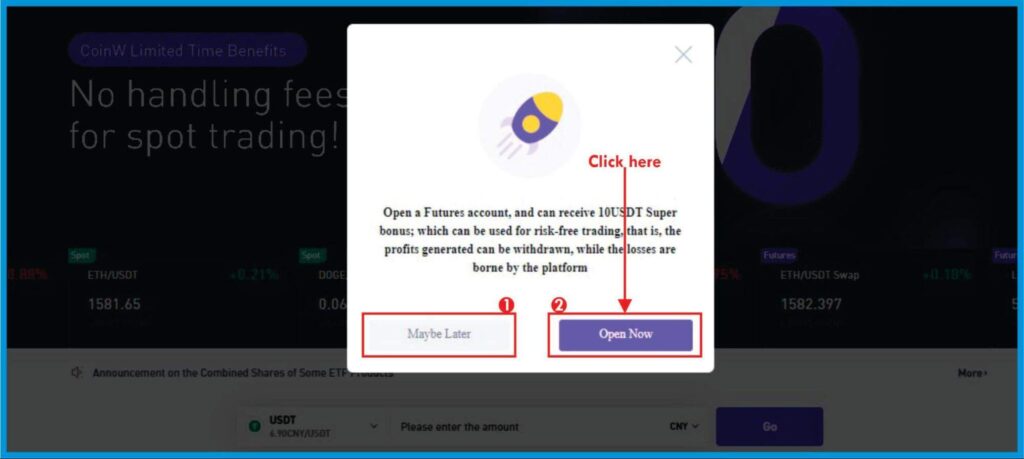

After successfully login in, you will see a pop that says open a futures account like the one below.

Quick one, the pop-up will always come each time you log in, provided you haven’t opened futures account with CoinW.

So, click “Open Now,” as you can see above. On the next page, you will be asked if you are a beginner or a pro.

With the options “No, I’m green” and “Yes, I know everything.”

If you want to take some tutorials and personalized dashboards from CoinW directly, you should choose “No, I’m green.”

On the other hand, if you already know what you are doing, just go for the latter option.

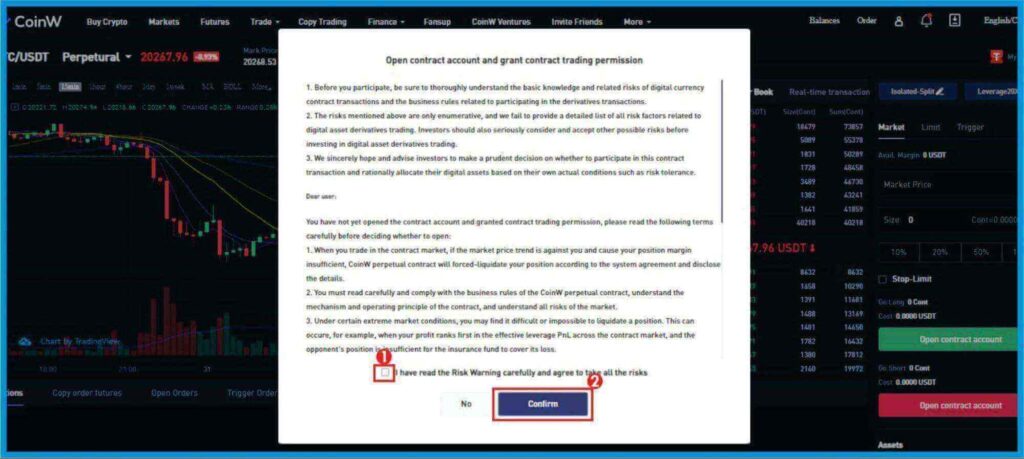

After that, I mean, after clicking on “Yes, I know everything,” you will be redirected to the page below.

What you see above is the CoinW futures contract agreement; you can decide to go through it or skip it.

Either you have decided to do it, or you need to tick the small box that says you have agreed with the terms and then click on the “Confirm Button.”

What you have next after that is the futures contract homepage. Then you can begin your trading journey from there.

Mobile App

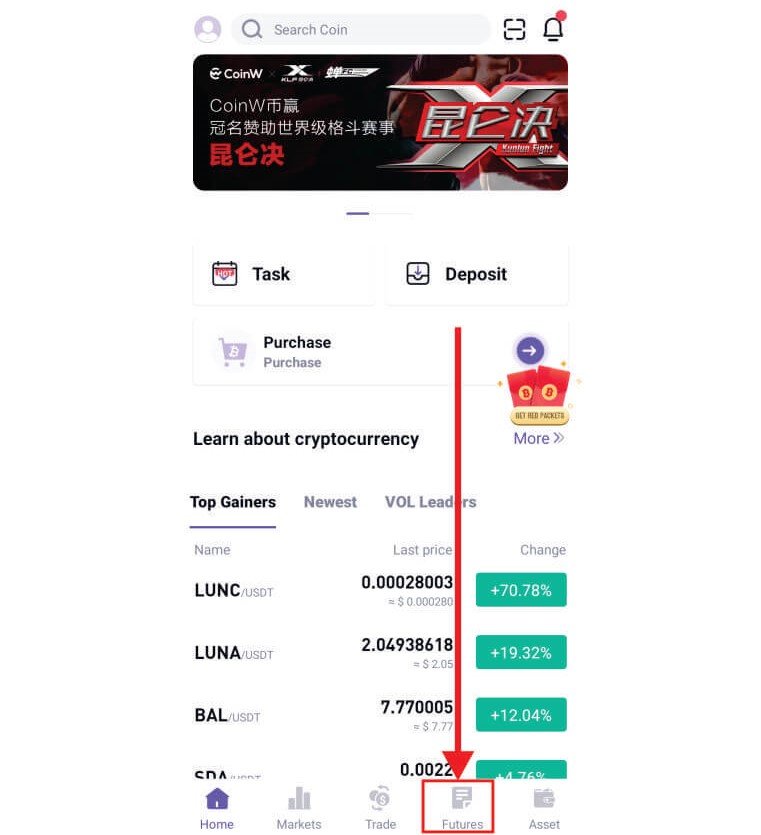

If you use the mobile app, login into your account and click on futures next to the asset button.

You will be asked if you are a beginner or a pro. Select the one that applies to you.

Agree to the terms and conditions on the next page; your futures account will be successfully opened by now.

Do you get it all right? If yes, I want to say congratulations; if no, just comment below and I will help you out.

2. Deposit into your Futures Account

Before you can deposit into your futures account, you must have funds in your CoinW account.

And to have funds in it means you need to deposit first. We have already created in-depth content that shows you how to deposit on CoinW.

Check it; after you have made a successful deposit, you can continue here to learn how to deposit into your future account.

Deposit on Web

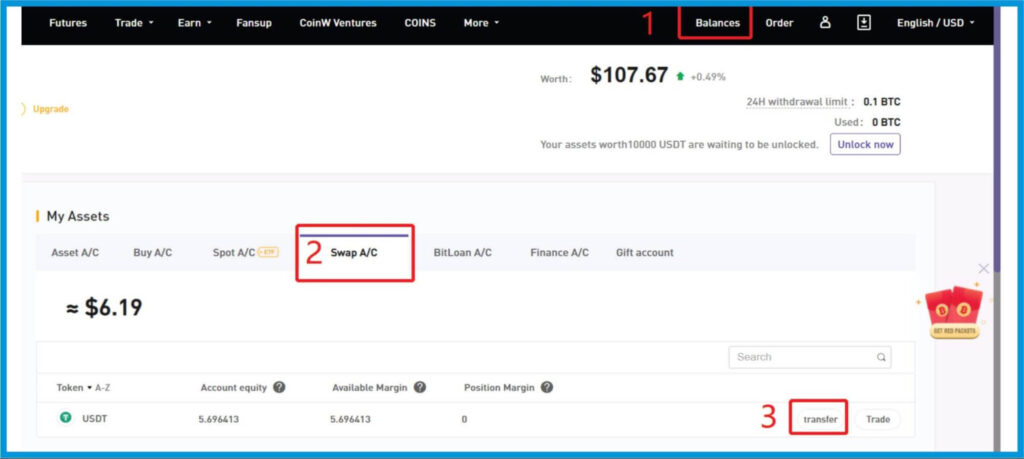

The next you need to do now, after a successful deposit, is to transfer funds between the asset and futures account.

To do that, click on assets, futures account, and transfer.

The image below can help you if you are confused.

And that leads us to the next chapter, depositing on the mobile app.

Deposit on Mobile App

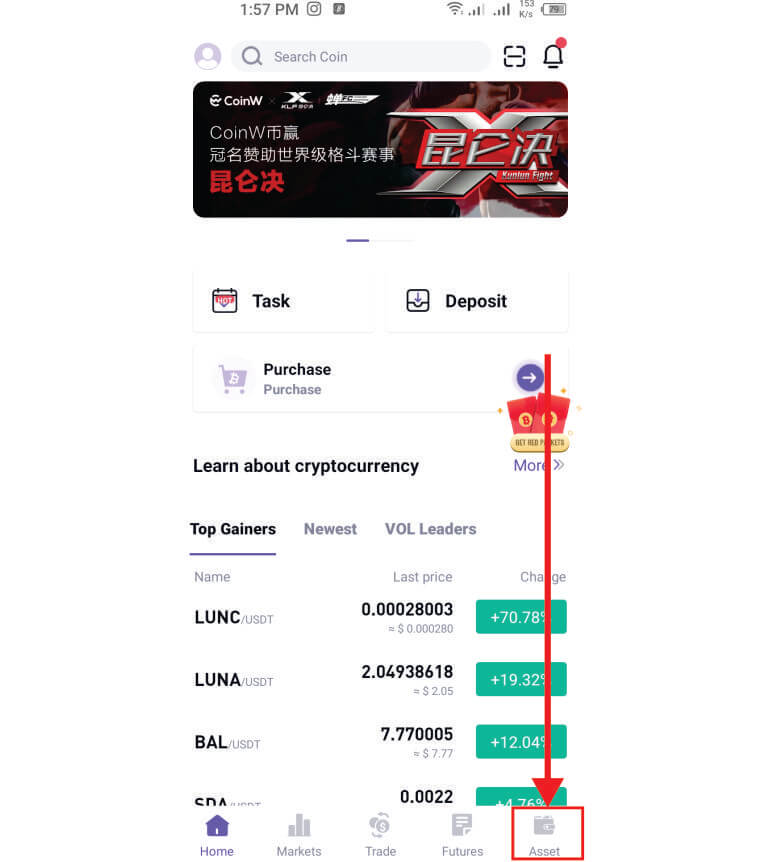

The first you need to do is to login into your account on the mobile app.

After successful login, click on the asset icon, the last icon on the home page.

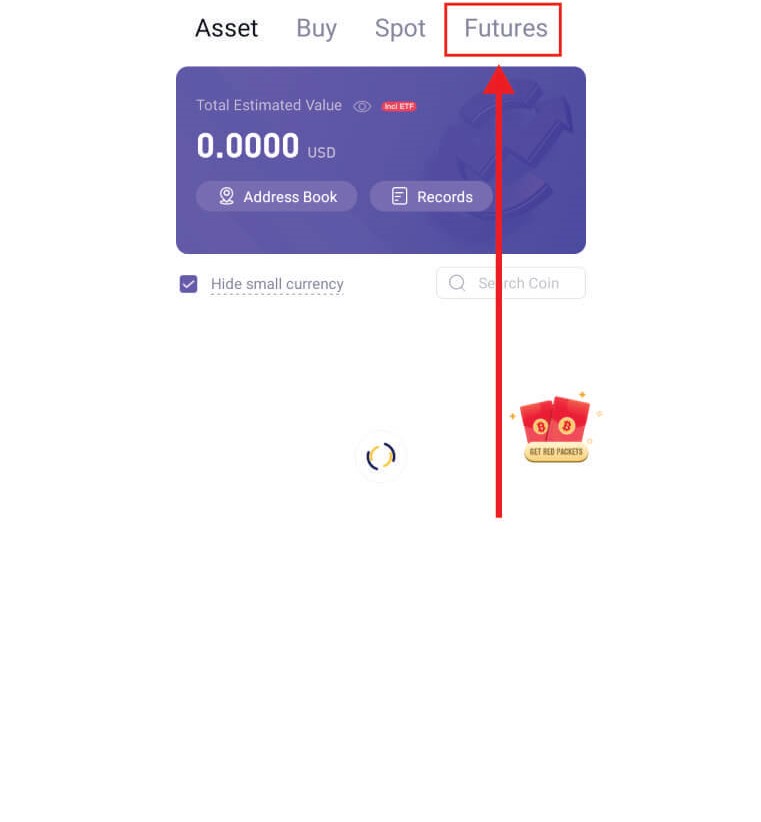

On the next page, click on futures on the upper side of the app.

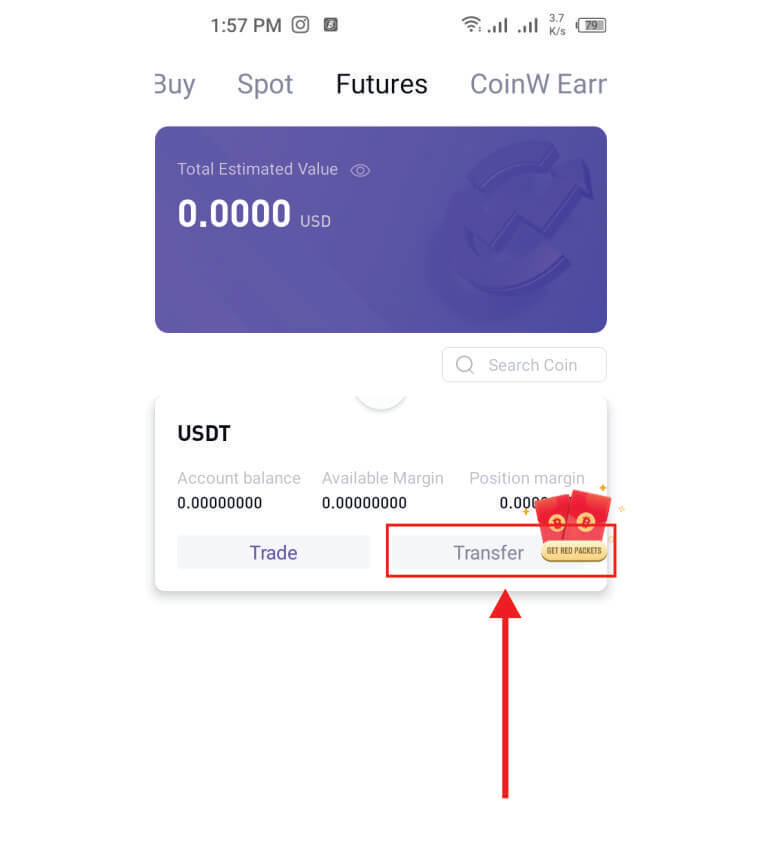

After that, click on a transfer, just like the image below.

The next page will ask you to input the amount of USDT you want to transfer. Click on transfer after that.

Boom, you have just learned to deposit into a CoinW futures account on the web and mobile apps.

How to Trade Futures on CoinW

We will be looking at all there’s to know on how to trade futures on CoinW here; learn the knowledge that has been explained below and apply it when you start trading.

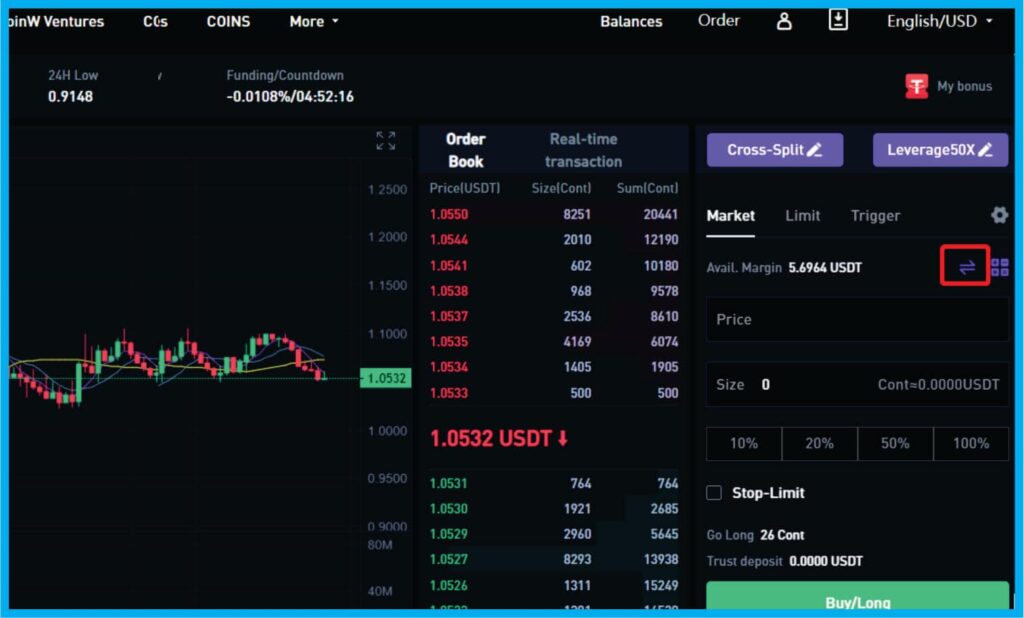

CoinW Futures Interface

So, let’s look at the CoinW user interface shown below.

CoinW Futures Trading: Order Type

Here are some other types you need to know about as you begin your futures trading with CoinW.

1. Market Order

A market order, as it implies, allows you to buy and sell an asset at the best possible current market price. It typically ensures execution but doesn’t guarantee a specific price.

The market order is handy when the primary aim is to execute a trade or sell off an asset.

2. Limit Order

A limit order can be used to buy either at a lower price or to sell off an asset at a higher price.

Keep in mind that once the limit order is placed, the system doesn’t longer accept buying at a high price and selling at lower prices.

If in any case, you buy at any case, you buy at high prices and sell at low prices; the transaction will be executed immediately at the current market price.

A handling fee of 0.06% will also be applied.

3. Trigger Order

As the name implies, a trigger order is an order a trader sets for a trade to be executed when a target is reached.

Trigger orders are generally for future contracts, so you don’t use them instantly while trading.

You only use it based on future purposes. For example, trade is to be executed when an asset reaches a specific price, either low or high.

4. Take Profit and Loss

Take profit and loss is a system designed to terminate the trade once your target is reached automatically.

For example, if you have an asset worth $10 and use it for trading, then you instruct the system to take profit when it gets to $12.

The system automatically terminates the trade once it gets to $12.

On the other hand, the stop loss is an instruction you give the system to terminate the trade while losing automatically.

For example, if you are trading a fixed asset of $10 and instruct the system to stop loss if it reaches $9, that is losing instead of profiting.

Then, the system will automatically terminate; this is specifically good if you are a busy trader that can’t monitor the chart.

Who should trade futures on CoinW?

Futures trading is for many categories of people, from beginners to pros.

If you are already a pro, then it’s a good idea you start using CoinW for trading futures because of its simple yet effective user interface.

It will give you a good trading experience and help you make more money since you aren’t dealing with a junk-designed site.

Using CoinW to trade futures will offer you many additional advantages if you are a beginner.

You will have access to top-notch free signals to trade, and you can easily make between $100-$500 daily if you follow correctly.

You will also be able to execute those trades yourself since the CoinW futures trading user interface is designed for beginners.

Judging from the analysis I have given above, you will see that CoinW futures trading meets all categories of people.

Regardless of where you fall into, beginners, semi-pros, and the pros themselves.

Conclusion

CoinW is an excellent and reliable platform for futures trading and related trading.

It aids beginners in mastering the act of trading by giving a simple and well-designed site to trade.

It also supplies free trading signals for them to make the best out of the trading market.

While the pros can make so much more money, it will always be a win-win game for all parties.

With that, we have reached the end of “How to trade futures on CoinW.”

Please let me know your thoughts about the topic by using the comments section below.

Frequently asked questions

Let’s quickly run through frequently asked questions we receive nearly daily.

You can trade futures on CoinW for as low as $100 and $10,000. Remember that the amount of money you use in trading determines your returns.

Yes, CoinW futures are worth it; besides, futures are great for hedging and diversification, so it’s never a wrong idea.

You can make Between $100 to $500; your amount will also be based on your trading strategies