In this article, we’d learn how to trade on CoinW mobile app. Cryptocurrency trading has recently increased and is not slowing down anytime soon.

Buying or selling cryptocurrency is a popular activity among cryptocurrency traders. As cryptocurrency has a market like the financial industry, crypto traders have different rules.

You will have to analyze and understand the market before trading to avoid incurring losses that might be detrimental to your future trading success.

The CoinW mobile app offers you the benefit of keeping an eye on the crypto market. You can look at the market, make trading decisions with your smartphone, and make money.

This article will reveal the various trading options available on the CoinW mobile app.

Just a quick one before we dive into the business of the day, if you haven’t downloaded the CoinW mobile app, simply download it on Google Playstore or App Store, depending on your device, and register an account with CoinW. It’s straightforward!

With that out of the way, let’s proceed.

What is Crypto Trading?

Crypto trading is simply estimating the prices of cryptocurrencies using predictable trends and performances using a CFD (Contract for difference) or exchange market.

Crypto trading can also be seen as buyers and sellers making economic guesses to make profits.

Contract for Difference (CFD)

CFDs are a popular way to trade cryptocurrencies because they permit flexibility and leverage. Users are permitted to take short and long positions.

The short and long positions enable traders to determine the risks involved in trading cryptocurrency and make the right decisions. A short is known as ‘sell’ while a long is known as ‘buy’-in cryptocurrency.

Crypto exchange market

A popular method of trading cryptocurrencies is on the exchange market. Both crypto owners and traders can exchange or trade on the market.

Different crypto trading platforms give you access to the market. Some of which are Binance and CoinW. To sell a coin on the exchange market, you should first create an exchange account, use the total value of the cryptocurrency to set the price, and store your coin(s) in your wallet until you are ready to sell.

Traders who use the exchange market for trading will have to learn new methods to adapt to the technology and understand the data they are presented with. This comes with a steep learning curve you would adapt to as time passes.

Are cryptocurrencies legal?

Cryptocurrencies are legal, though they’ve been declared illegal in certain regions of the world.

In those regions, they are not considered legal tender because they are not issued by the government and are usually volatile. However, this is currently being improved with the creation of stablecoins whose monetary value is attached to a fixed asset.

Crypto has created changes in the financial industry. A revolution has occurred in the industry due to these changes.

Buyers can choose to “long-buy” whenever they feel a coin’s value is about to increase or has potential.

A “long buy” benefits the buyers in the long run because they have analyzed that it is profitable to buy at such price and time using the present trends. At the same time, sellers can short-sell their coins whenever they need to do so.

This helps the sellers reduce the loss of potential cryptocurrency crashes, and the buyers avoid incurring losses.

Types of cryptocurrencies

Over a hundred cryptocurrencies exist presently. The most popular is the first ever cryptocurrency – Bitcoin.

These existing cryptocurrencies traded on the market are categorized into specific types, some of which are those intended to provide an alternative to fiat currencies, like the Bitcoin and Lite coin.

Fiat currencies are money that does not have backing from any commodity like gold or silver. The government of a country typically declares fiat money as a legal tender used to carry out buying and selling activities.

Requirements to trade on CoinW

Before you trade on the CoinW platform, there are some requirements you should meet. Some of which are;

1. Download the mobile app

To get started, download CoinW mobile app from Google Playstore or App store depending on your device.

Sign into your existing account or register an account if you do not have one.

Fill in the required details and complete the verification. It is important to note that two types of verification are required; primary identity verification and advanced identity verification.

The primary identity verification allows you to perform trading activities with minor restrictions on your activities. It is best to complete the secondary identity verification to avoid these restrictions.

To complete the advanced identity verification, you must complete the primary identity verification as a prerequisite.

Read this post to learn everything you need to know about CoinW identity verification and how to do it. To access the best trading resources, you are advised to complete all types of verification.

2. Deposit into your account

After downloading the mobile app and creating your account, deposit into your account and fund your wallet.

If you trade on a large scale, you will deposit a reasonably large amount into your account. If you want to trade on a large scale, you do not need to start with a large amount of money. Simply start with a good amount, though good depends on you!

3. Invest in a cryptocurrency

After funding your account, you can choose which cryptocurrency or coin to invest in from the majority. Investing in a cryptocurrency requires you to know what the present market is like before taking the bold step. On CoinW, there are 50+ cryptocurrencies you can choose from to invest in.

It is important to note that there are days when the price of the cryptocurrency will appreciate or depreciate. Your ability to understand those days and make the right decisions would determine your profits or losses. You can then go ahead to withdraw your profits once you make them.

How to trade on CoinW

There are presently three types of trading on the CoinW platform: Spot trading, Futures trading, and ETF trading. Each comes with different benefits and offers to its users. Below is information on each trading option, its features, and how to trade on each option.

Spot Trading

Spot trading is the buying and selling of cryptocurrency on the exchange market. In other words, it involves using a cryptocurrency to purchase another cryptocurrency. The aim is usually to make a profit.

Spot trading is used to match trade in order of price and time priority. If you want to buy or sell, enter the price and amount, and select buy or sell. It is important to note that spot trading is subject to price fluctuations which are usually a result of buyer’s sentiments like security and availability.

On the positive side, spot trading gives accurate cryptocurrency prices for traders to make profitable decisions. However, it is worth mentioning that the spot trading market is less regulated than other trading markets.

Futures trading

Futures trading is a trade that allows traders to open a position in the futures market. The position opening is usually a Futures trading account.

You do not own the underlying cryptocurrency but a contract that you will buy or sell the specific cryptocurrency. You can incur losses when trading on the futures market.

Creating a futures account is accessible on the CoinW mobile app.

First, sign in to your existing account, choose Futures trading, and create a Futures account.

To trade on the Futures market, one must deposit an amount into his Futures account.

On the CoinW app, users get a 10 USD trading bonus when they sign up and can use it for trading in their futures accounts. Trading on the futures market involves making predictions on the price of an asset.

For example, when you predict that the value of an asset priced at $20 will increase, and it does increase, the platform will automatically sell it for you – hence you have made a profit. But if it depreciates, the platform will still sell it automatically, and you will have made a loss on your asset.

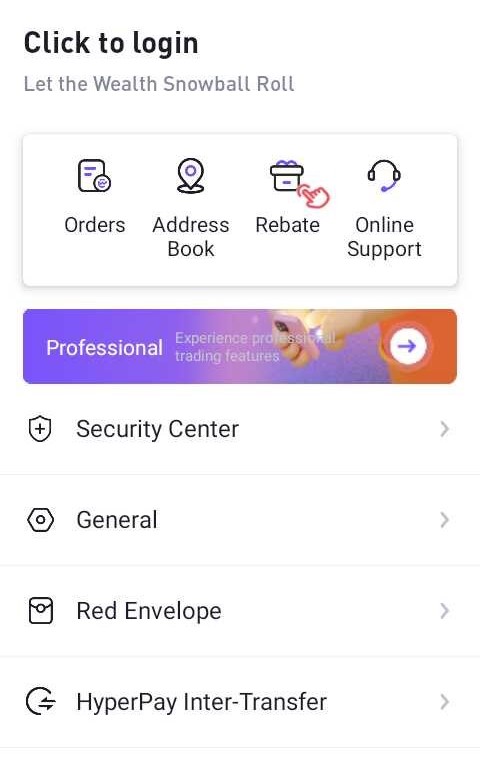

To use the app for your futures trading, you will be presented with an interface like the one below. Provide all the needed details, and log in to your account.

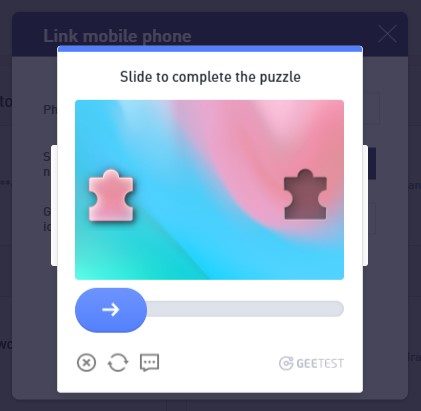

To complete the process, slide the puzzle to fit. This is necessary to ensure that users on the platform are real humans, not robots.

After completing the puzzle, you would have successfully logged in to your account. Then create a Futures account. Before creating a futures account, you will be asked to accept the terms and conditions.

After accepting the terms and conditions, choose to confirm, and you successfully create your futures account.

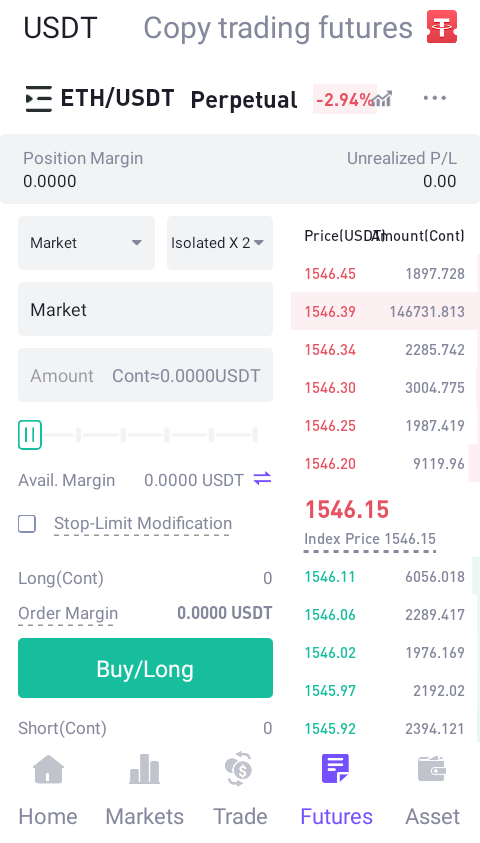

On the future’s platform, you can choose to go either long or short, i.e., buy or sell, after setting the maximum and minimum price details before trading. You can also set limits to avoid higher risks.

It is important to note that either the buyer must purchase or the seller must sell their underlying assets at the set price whenever the expiration date is due.

ETF trading

Exchange Traded Fund is a trade investment with multiple underlying assets.

These multiple assets set a means of security for funds, as cryptocurrencies have a share price that allows them to be bought easily and sold on exchange markets throughout the day.

To trade on the CoinW exchange using the ETF trading, log in to your account or create an account if you do not have one.

It is also essential to pay attention to the controlling risks involved, as the price constantly fluctuates, so in choosing a cryptocurrency, pay attention to the product, as prices are bound to change once in a while on the ETF.

ETFs are highly volatile, and due to the inherent market risks, slippage, and position adjustment algorithms, the net value of ETFs may return to zero.

It is essential to pay attention to the net value before trading. Under extreme market conditions, the cryptocurrency will risk approaching price zero, and the price will be far away from the net value. Investors – both buyers and sellers, should pay attention to controlling risks.

Conclusion

Cryptocurrency trading requires an in-depth knowledge of the market. It requires good skills and critical analysis.

If you want to trade cryptocurrencies, it is best to possess skills that will help you analyze the market because of the risks involved. The volatility of cryptocurrency makes it such that the risks involved in crypto trading are higher than the usual financial trading you do.

An analysis is vital because if you do it right, the volatility becomes an advantage, but if you do not analyze properly, the risks involved might be higher than you are willing to take.

When choosing a cryptocurrency exchange for trading, choosing one that offers the best security, trading volumes, informational resources, and user experience is essential. Also important is to check if the exchange platform lists the cryptocurrency you wish to invest in on its exchange.

Whichever way you want to trade on the CoinW exchange, you can be sure that with the proper methods and analysis, making a profit will be the icing on the cake.

Take time to understand how to navigate the platform, and study each trading option to choose the best one for you.

Frequently Asked Questions

Cryptocurrencies can be traded in different ways. The most popular options are on an exchange market or using financial derivative instruments such as the CFD.

Trading cryptocurrencies is just like trading in other markets. You need skills. To trade cryptocurrencies, ensure you have the right skills and adequate resources.

A digital currency is usually issued and backed by a central authority, while a cryptocurrency is decentralized and not issued by a centralized authority.